Top Guidelines Of How Much Is Car Insurance A Month

Almost every staff member now carries a smart device, which permits HR advantages supervisors to make social media posts and text messaging part of their open registration toolkit. Here are suggestions for the upcoming open enrollment season. As the year ended, HR covered up another open registration season. Before proceeding, nevertheless, standing back and evaluating what went smoothly and what tripped you up can make sure a much easier, more effective process when next fall rolls around.

Their success brings lessons for HR teams of all sizes. The fall open registration season is a time that some HR professionals dread as an administrative nightmare while others see an opportunity to personally engage with staff members, and to help them make options that will secure their health and financial wellness.

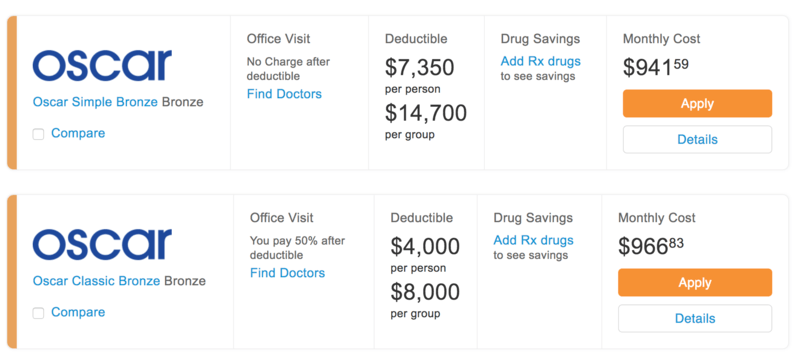

More companies are making high-deductible health insurance (HDHPs) an optionor, significantly, the sole choicefor employer-sponsored health protection. So it's important to offer clear communication that helps workers comprehend how HDHPs run and whether the plans are best for them. Open enrollment is an opportunity to assist employees comprehend the worth of a health savings account (HSA), but many employers make common mistakes that weaken their communication efforts.

Absence of understanding about their dental coverage can cause employees to avoid routine examinations and routine cleansings, causing more expensive and invasive treatments later on.

Healthcare is a leading concern for lots of Latinos and despite hazards to undermine our country's healthcare system, the Affordable Care Act (ACA) remains the law of the land. Thanks to the ACA, countless Americans, including, have accessed to quality, affordable health coverage. This Open Registration period we need to build on this progress and guarantee these gains are not reversed.

That's why it is essential that you register in a healthcare plan before the. No 2 strategies are the same, and protection choices change from year to year. The excellent news is there are tools available to compare strategies so you can choose the one that's finest for you and your family.

Our How Long Does It Take For Gap Insurance To Pay PDFs

PRO SUGGESTION: Avoid strategies marketed by representatives and brokers that are not offered in the Market that might put you in financial threat. Whether you are restoring your present plan click here or registering for health coverage for the very first time, you might get approved for monetary support to buy a plan.

As the coronavirus pandemic continues to be a part of every day life, the 2021 Affordable Care Act (ACA) Open Registration Duration that runs from November 1 to December 15 provides the Latino neighborhood with a chance to register in health coverage with comfort knowing that they and their family are covered.

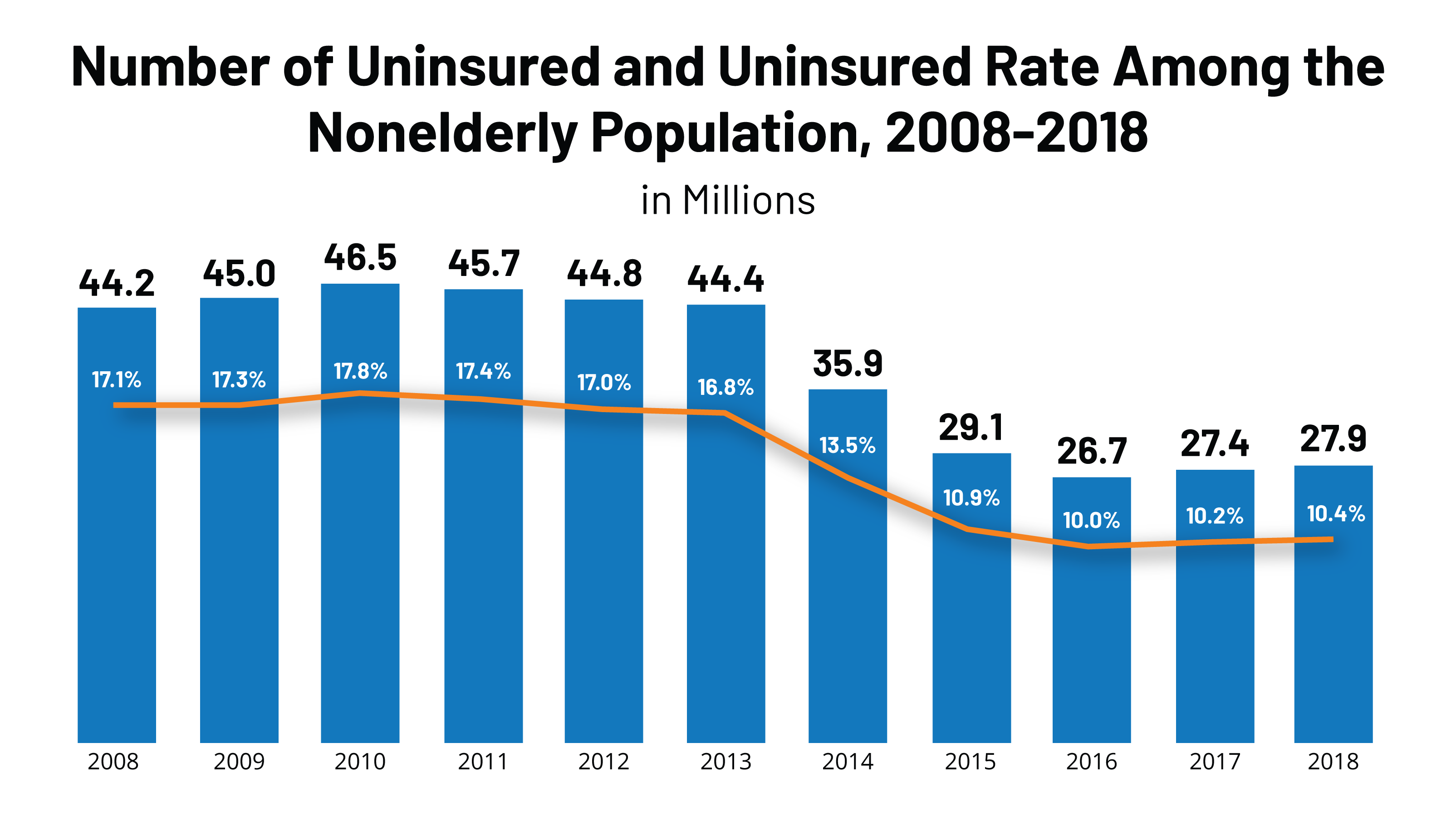

Since 2013, the ACA has actually offered 20 million Americans, including four million Latino grownups and 600,000 Latino kids, with access to health coverage and care. The 2020 Open Enrollment duration supplies our community with an opportunity to build on this historic development. Ensure to check back with us at UnidosUS.org for updates and extra resources so you and your household can Be sure to have a look at the for updates and associated stories on the ACA and the open enrollment period.

In every state, open enrollment for ACA-compliant 2021 health protection for people and families started on November 1, 2020. In the majority of states, it ended on December 15, 2020. The December 15 deadline http://garrettarzd170.huicopper.com/not-known-facts-about-how-long-can-you-stay-on-your-parents-health-insurance applies in every state that uses HealthCare. gov (that's 36 states in the fall of 2020) and it likewise used in two of the states that run their own exchanges.

However the 15 completely state-run exchanges have the choice to extend their open enrollment windows, and most of them have actually done so. (Since 2020, there were 13 fully state-run exchanges, but Pennsylvania and New Jersey have actually now joined them, bringing the overall to 15). Utilize our calculator to estimate how much you might save money on your ACA-compliant medical insurance premiums.

Idaho: November 1 to December 31, 2020 (how to get insurance to pay for water damage). Connecticut: November 1 to January 15, 2021. Pennsylvania: November 1, 2020, to January 15, 2021 Nevada: November 1, 2020, to January 15, 2021. Washington: November 1, 2020, to January 15, 2021. Massachusetts: November 1, 2020 to January 23, 2021. Rhode Island: November 1, 2020 to January 23, 2021.

How To Fight Insurance Company Totaled Car Things To Know Before You Buy

New York: November 1, 2020 to January 31, 2021. There are just two other totally state-run exchanges (in Vermont and Maryland). They are the only other states that have the alternative to extend open enrollment on their own. The rest of the nation uses the Health care. gov exchange platform, with a December 15 enrollment deadline set by the federal government.

Premium aids (premium tax credits) are offered in every state to make private market (ie, self-purchased) medical insurance budget friendly. Eligibility is based on the candidate's household income. Here's an in-depth summary of how superior aids work, and a calculator you can use to see if you're qualified for a subsidy.

Here's how family income is determined under ACA guidelines. It's referred to as MAGI, for modified adjusted gross earnings, however it's not the exact same as the basic MAGI estimations you might be familiar with in other scenarios. If your income is a little too expensive to qualify for subsidies, there are actions you might have the ability to require to get it into the subsidy-eligible variety - how much does long term care insurance cost.

2 million individuals getting premium subsidies in the exchanges nationwide, and their average aid amount was almost $500 per month. If you have not examined to see if you might get financial assistance with your health insurance coverage, make sure you do so during the open registration duration for 2021 health coverage.

Regardless of the technique, if you're registering in a plan through the exchange, you're going to need to have the following information on hand for each enrollee: Name, address, e-mail address, social security number, birthday, and citizenship status. (Proof of legal residency status might be required). Family size Check out the post right here and earnings (if you're preparing to obtain premium subsidies or cost-sharing reductions) - when does car insurance go down.

Coverage information and premium for any employer-sponsored strategy that's available to your family (despite whether you're registered in that plan or have decreased it). Payment information that the insurance company will have the ability to use to charge your premiums. Your medical professionals' names and zip codes, so that you can check to make certain they're in-network with the health plans you're thinking about.

The Best Guide To What Is Coinsurance In Health Insurance

Each insurance coverage strategy has its own formulary (covered drug list), so you'll wish to examine to see which one will best cover the medications you require. If you want to enlist in a devastating strategy and you're 30 or older, you'll need hardship exemption (note that premium aids can not be utilized with devastating plans, so these are usually just an excellent idea if you do not qualify for a premium subsidy, but can meet the requirements for a hardship exemption).

4 Easy Facts About How Much Does A Filling Cost Without Insurance Explained

Practically every worker now carries a mobile phone, which allows HR benefits managers to make social networks posts and text messaging part of their open enrollment toolkit. Here are ideas for the upcoming open registration season. As the year ended, HR concluded another open registration season. Before proceeding, however, standing back and examining what went efficiently and what tripped you up can guarantee a simpler, more efficient process when next fall rolls around.

Their success brings lessons for HR teams of all sizes. The fall open registration season is a time that some HR experts fear as an administrative problem while others see a chance to personally engage with workers, and to help them choose that will secure their health and financial wellness.

More business are making high-deductible health insurance (HDHPs) an optionor, significantly, the sole choicefor employer-sponsored health protection. So it is very important to provide clear interaction that helps employees comprehend how HDHPs operate and whether the strategies are best for them. Open registration is a chance to help employees understand the worth of a health savings account (HSA), however lots of companies make common errors that undermine their interaction efforts.

Absence of understanding about their oral coverage can trigger employees to skip routine checkups and regular cleansings, resulting in more costly and invasive treatments later on.

Health care is a leading concern for lots of Latinos and regardless of dangers to undermine our nation's healthcare system, the Affordable Care Act (ACA) stays the unwritten law. Thanks to the ACA, countless Americans, consisting of, have gotten to quality, budget friendly health protection. This Open Enrollment duration we should build on this development and guarantee these gains are not reversed.

That's why it is very important that you enlist in a health care strategy before the. No two plans are the very same, and coverage choices modification from year to year. Fortunately is there are tools available to compare strategies so you can choose the one that's best for you and your family.

Top Guidelines Of How Much Is Health Insurance A Month

PRO POINTER: Prevent strategies marketed by representatives and brokers that are not offered in the Market that might put you in financial threat. Whether you are restoring click here your present strategy or signing up for health protection for the very first time, you might qualify for financial backing to purchase a plan.

As the coronavirus pandemic continues to belong of every day life, the 2021 Affordable Care Act (ACA) Open Enrollment Period that runs from November 1 to December 15 supplies the Latino neighborhood with an opportunity to register in health protection with assurance understanding that they and their family are covered.

Considering that 2013, the ACA has actually offered 20 million Americans, consisting of 4 million Latino grownups and 600,000 Latino kids, with access to health protection and care. The 2020 Open Enrollment duration supplies our community with an opportunity to construct on this historic development. Make sure to check back with us at UnidosUS.org for updates and additional resources so you and your household can Be sure to take a look at the for updates and associated stories on the ACA and the open registration period.

In every state, open registration for ACA-compliant 2021 health protection for people and families began on November 1, 2020. In the majority of states, it ended on December 15, 2020. The December 15 due date applies in every state that utilizes Health care. gov (that's 36 states in the fall of 2020) and it likewise used in 2 of the states that run their own exchanges.

But the 15 totally state-run exchanges have the choice to extend their open enrollment windows, and most of them have done so. (Since 2020, there were 13 totally state-run exchanges, however Pennsylvania and New Jersey have actually now joined them, bringing the total to 15). Use our calculator to approximate how much you could minimize your ACA-compliant health insurance coverage premiums.

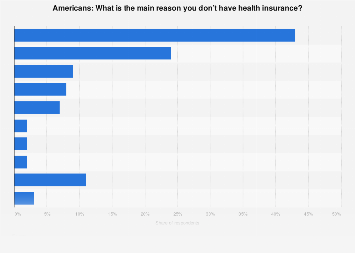

Idaho: November 1 to December 31, 2020 (how many americans don't have health insurance). Connecticut: November 1 to January 15, 2021. Pennsylvania: November 1, 2020, to January 15, 2021 Nevada: November 1, 2020, to January 15, 2021. Washington: November 1, 2020, to January 15, 2021. Massachusetts: November 1, 2020 to January 23, 2021. Rhode Island: November 1, 2020 to January 23, 2021.

What Does What Is E&o Insurance Mean?

New york city: November 1, 2020 to January 31, 2021. There are only two other totally state-run exchanges (in Vermont and Maryland). They are the only other states that have the option to extend open enrollment on their own. The remainder of the Check out the post right here country uses the Health care. gov exchange platform, with a December 15 enrollment deadline set by the federal government.

Premium aids (premium tax credits) are available in every state to make private market (ie, self-purchased) medical insurance budget-friendly. Eligibility is based upon the candidate's household earnings. Here's an in-depth summary of how premium subsidies work, and a calculator you can utilize to see if you're qualified http://garrettarzd170.huicopper.com/not-known-facts-about-how-long-can-you-stay-on-your-parents-health-insurance for an aid.

Here's how household earnings is calculated under ACA rules. It's described as MAGI, for customized adjusted gross earnings, but it's not the like the basic MAGI calculations you may be familiar with in other circumstances. If your earnings is a little too expensive to certify for subsidies, there are steps you might be able to take to get it into the subsidy-eligible range - how much should i be paying for car insurance.

2 million people getting premium aids in the exchanges nationwide, and their average subsidy amount was almost $500 per month. If you haven't examined to see if you might get financial support with your health insurance coverage, ensure you do so during the open registration period for 2021 health protection.

Regardless of the technique, if you're enrolling in a plan through the exchange, you're going to require to have the following information on hand for each enrollee: Call, address, email address, social security number, birthday, and citizenship status. (Proof of legal residency status might be required). Home size and income (if you're preparing to make an application for premium subsidies or cost-sharing reductions) - how long can my child stay on my health insurance.

Coverage details and premium for any employer-sponsored plan that's available to your household (despite whether you're enrolled in that strategy or have decreased it). Payment info that the insurance provider will be able to use to charge your premiums. Your medical professionals' names and postal code, so that you can examine to ensure they're in-network with the health plans you're considering.

Which Of The Following Typically Have The Highest Auto Insurance Premiums? Fundamentals Explained

Each insurance plan has its own formulary (covered drug list), so you'll desire to inspect to see which one will best cover the medications you require. If you wish to enlist in a disastrous plan and you're 30 or older, you'll require challenge exemption (note that premium subsidies can not be utilized with catastrophic strategies, so these are normally only an excellent concept if you do not certify for a premium aid, but can meet the requirements for a difficulty exemption).

The smart Trick of How Long Can You Stay On Parents Insurance That Nobody is Discussing

Nearly every employee now carries a smart device, which allows HR benefits supervisors to make social networks posts and text messaging part of their open registration toolkit. Here are suggestions for the upcoming open registration season. As the year ended, HR wrapped up another open registration season. Prior to moving on, however, standing back and reviewing what went smoothly and what tripped you up can ensure a simpler, more effective procedure when next fall rolls around.

Their success carries lessons for HR groups of all sizes. The fall open registration season is a time that some HR experts fear as an administrative headache while others see a chance to personally engage with staff members, and to assist them make options that will secure their health and monetary wellness.

More companies are making high-deductible health insurance (HDHPs) an optionor, progressively, the sole choicefor employer-sponsored health protection. So it is very important to offer clear interaction that helps staff members understand how HDHPs run and whether the strategies are ideal for them. Open enrollment is an opportunity to assist workers understand the worth of a health savings account (HSA), however numerous companies make common mistakes that weaken their Check out the post right here interaction efforts.

Absence of understanding about their oral protection can cause employees to skip routine examinations and regular cleansings, resulting in more pricey and intrusive treatments in the future.

Healthcare is a top issue for many Latinos and regardless of dangers to undermine our country's health care system, the Affordable Care Act (ACA) remains the unwritten law. Thanks to the ACA, countless Americans, including, have accessed to quality, inexpensive health protection. This Open Enrollment period we must build on this development and guarantee these gains are not reversed.

That's why it is essential that you register in a healthcare plan prior to the. No two plans are the exact same, and coverage alternatives change from year to year. The great news exists are tools offered to compare plans so you can choose the one that's best for you and your household.

9 Simple Techniques For How To Find A Life Insurance Policy Exists

PRO POINTER: Avoid strategies marketed by representatives and brokers that are not used in the Market that might put you in monetary danger. Whether you are renewing your current plan or registering for health coverage for the very first time, you may get approved for financial backing to purchase a strategy.

As the coronavirus pandemic continues to be a part of every day life, the 2021 Affordable Care Act (ACA) Open Registration Duration that ranges from November http://garrettarzd170.huicopper.com/not-known-facts-about-how-long-can-you-stay-on-your-parents-health-insurance 1 to December 15 offers the Latino community with a chance to enroll in health protection with peace of mind knowing that they and their household are covered.

Considering that 2013, the ACA has actually supplied 20 million Americans, including four million Latino grownups and 600,000 Latino children, with access to health coverage and care. The 2020 Open Registration duration offers our community with a chance to build on this historic progress. Make sure to check back with us at UnidosUS.org for updates and extra resources so you and your family can Be sure to have a look at the for updates and associated stories on the ACA and the open enrollment duration.

In every state, open registration for ACA-compliant 2021 health protection for people and families started on November 1, 2020. In many states, it ended on December 15, 2020. The December 15 due date applies in every state that utilizes Health care. gov (that's 36 states in the fall of 2020) and it likewise applied in 2 of the states that run their own exchanges.

But the 15 completely state-run exchanges have the option to extend their open enrollment windows, and many of them have done so. (Since 2020, there were 13 totally state-run exchanges, but Pennsylvania and New Jersey have actually now joined them, bringing the overall to 15). Use our calculator to approximate how much you could save on your ACA-compliant medical insurance premiums.

Idaho: November 1 to December 31, 2020 (what does no fault insurance mean). Connecticut: November 1 to January 15, 2021. Pennsylvania: November 1, 2020, to January 15, 2021 Nevada: November 1, 2020, to January 15, 2021. Washington: November 1, 2020, to January 15, 2021. Massachusetts: November 1, 2020 to January 23, 2021. Rhode Island: November 1, 2020 to January 23, 2021.

7 Simple Techniques For How To Become An Insurance Adjuster

New york city: November 1, 2020 to January 31, 2021. click here There are only two other completely state-run exchanges (in Vermont and Maryland). They are the only other states that have the choice to extend open enrollment on their own. The rest of the nation uses the HealthCare. gov exchange platform, with a December 15 registration deadline set by the federal government.

Premium subsidies (premium tax credits) are available in every state to make individual market (ie, self-purchased) health insurance coverage affordable. Eligibility is based upon the candidate's household earnings. Here's an in-depth summary of how superior aids work, and a calculator you can utilize to see if you're eligible for a subsidy.

Here's how home income is computed under ACA rules. It's referred to as MAGI, for customized adjusted gross earnings, however it's not the same as the basic MAGI computations you may be familiar with in other scenarios. If your earnings is a little too high to get approved for subsidies, there are actions you might have the ability to take to get it into the subsidy-eligible range - how much does it cost to go to the dentist without insurance.

2 million individuals receiving premium subsidies in the exchanges nationwide, and their typical aid quantity was nearly $500 monthly. If you have not examined to see if you could get financial assistance with your health insurance, ensure you do so throughout the open enrollment duration for 2021 health protection.

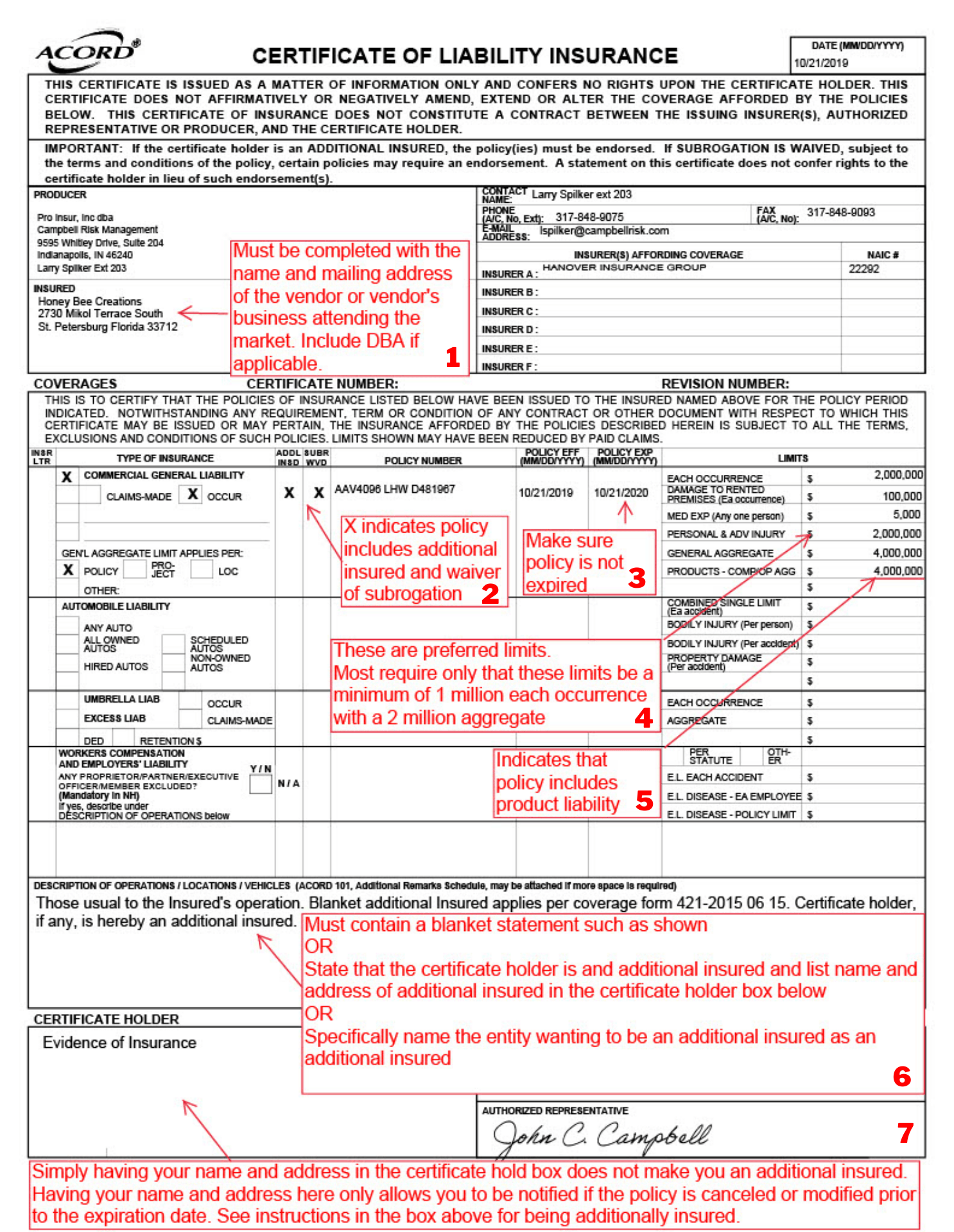

Despite the technique, if you're enrolling in a strategy through the exchange, you're going to need to have the following info on hand for each enrollee: Call, address, e-mail address, social security number, birthday, and citizenship status. (Evidence of legal residency status may be needed). Household size and income (if you're planning to look for premium aids or cost-sharing decreases) - what is a certificate of insurance.

Coverage details and premium for any employer-sponsored plan that's available to your home (regardless of whether you're enrolled in that plan or have declined it). Payment details that the insurer will be able to use to charge your premiums. Your doctors' names and postal code, so that you can inspect to ensure they're in-network with the health plans you're thinking about.

Everything about How Long Do You Have Health Insurance After Leaving A Job?

Each insurance coverage strategy has its own formulary (covered drug list), so you'll desire to examine to see which one will best cover the medications you need. If you wish to register in a devastating strategy and you're 30 or older, you'll require difficulty exemption (note that premium subsidies can not be used with disastrous plans, so these are typically just a great idea if you do not certify for a premium aid, but can fulfill the requirements for a difficulty exemption).

How Much Does It Cost To Fill A Cavity With Insurance for Dummies

Practically every employee now carries a mobile phone, which enables HR benefits managers to make social networks posts click here and text messaging part of their open registration toolkit. Here are ideas for the upcoming open registration season. As the year ended, HR concluded another open enrollment season. Prior to moving on, however, standing back and reviewing what went smoothly and what tripped you up can guarantee a much easier, more reliable procedure when next fall rolls around.

Their success carries lessons for HR groups of all sizes. The fall open enrollment season is a time that some HR specialists fear as an administrative nightmare while others see a chance to personally engage with workers, and to assist them choose that will protect their health and financial well-being.

More companies are making high-deductible health strategies (HDHPs) an optionor, progressively, the sole choicefor employer-sponsored health coverage. So it is very important to supply clear communication that helps employees comprehend how HDHPs operate and whether the strategies are ideal for them. Open registration is an opportunity to assist workers comprehend the worth of a health cost savings account (HSA), but numerous employers make typical errors that undermine their interaction efforts.

Lack of understanding about their dental protection can trigger employees to skip routine examinations and routine cleanings, causing more costly and intrusive treatments later.

Healthcare is a top issue for many Latinos and in spite of threats to undermine our nation's healthcare system, the Affordable Care Act (ACA) stays the law of the land. Thanks to the ACA, countless Americans, consisting of, have actually accessed to quality, affordable health coverage. This Open Enrollment duration we should develop on this development and guarantee these gains are not reversed.

That's why it is essential that you enroll in a healthcare plan prior to the. No 2 plans are the very same, and protection alternatives change from year to year. The bright side exists are tools readily available to compare plans so you can select the one that's finest for you and your family.

The Buzz on How To Fight Insurance Company Totaled Car

PRO SUGGESTION: Prevent strategies marketed by representatives and brokers that are not used in the Marketplace that could put you in monetary danger. Whether you are renewing your existing strategy or signing up for health coverage for the very first time, you might receive financial assistance to buy a strategy.

As the coronavirus pandemic continues to belong of every day life, the 2021 Affordable Care Act (ACA) Open Registration Duration that ranges from November 1 to December 15 offers the Latino neighborhood with an opportunity to enlist in health coverage with comfort understanding that they and their family are covered.

Because 2013, the Check out the post right here ACA has actually provided 20 million Americans, consisting of four million Latino adults and 600,000 Latino kids, with access to health coverage and care. The 2020 Open Enrollment duration offers our neighborhood with an opportunity to build on this historical progress. Ensure to check back with us at UnidosUS.org for updates and additional resources so you and your household can Be sure to take a look http://garrettarzd170.huicopper.com/not-known-facts-about-how-long-can-you-stay-on-your-parents-health-insurance at the for updates and related stories on the ACA and the open registration duration.

In every state, open registration for ACA-compliant 2021 health coverage for individuals and households started on November 1, 2020. In most states, it ended on December 15, 2020. The December 15 due date applies in every state that uses Health care. gov (that's 36 states in the fall of 2020) and it likewise applied in two of the states that run their own exchanges.

However the 15 totally state-run exchanges have the option to extend their open enrollment windows, and many of them have done so. (As of 2020, there were 13 completely state-run exchanges, but Pennsylvania and New Jersey have now joined them, bringing the total to 15). Utilize our calculator to approximate just how much you could save money on your ACA-compliant medical insurance premiums.

Idaho: November 1 to December 31, 2020 (how much does a tooth implant cost with insurance). Connecticut: November 1 to January 15, 2021. Pennsylvania: November 1, 2020, to January 15, 2021 Nevada: November 1, 2020, to January 15, 2021. Washington: November 1, 2020, to January 15, 2021. Massachusetts: November 1, 2020 to January 23, 2021. Rhode Island: November 1, 2020 to January 23, 2021.

The 8-Second Trick For What Is The Best Dental Insurance

New York: November 1, 2020 to January 31, 2021. There are just 2 other fully state-run exchanges (in Vermont and Maryland). They are the just other states that have the choice to extend open registration on their own. The rest of the country uses the Health care. gov exchange platform, with a December 15 registration deadline set by the federal government.

Premium subsidies (premium tax credits) are offered in every state to make private market (ie, self-purchased) medical insurance budget friendly. Eligibility is based on the applicant's home income. Here's a detailed overview of how exceptional subsidies work, and a calculator you can use to see if you're qualified for an aid.

Here's how home income is determined under ACA guidelines. It's referred to as MAGI, for modified adjusted gross earnings, however it's not the very same as the general MAGI calculations you may recognize with in other circumstances. If your earnings is a little too expensive to certify for subsidies, there are steps you may be able to require to get it into the subsidy-eligible range - what is e&o insurance.

2 million people getting premium aids in the exchanges nationwide, and their average aid amount was almost $500 each month. If you have not checked to see if you might get monetary support with your health insurance, make certain you do so during the open registration period for 2021 health coverage.

Regardless of the approach, if you're enrolling in a plan through the exchange, you're going to require to have the following details on hand for each enrollee: Name, address, email address, social security number, birthday, and citizenship status. (Proof of legal residency status may be needed). Family size and income (if you're planning to apply for premium aids or cost-sharing reductions) - how long does an accident stay on your insurance.

Coverage details and premium for any employer-sponsored strategy that's readily available to your family (despite whether you're registered because strategy or have declined it). Payment information that the insurer will have the ability to use to charge your premiums. Your medical professionals' names and zip codes, so that you can inspect to ensure they're in-network with the health plans you're thinking about.

More About What Is A Premium In Health Insurance

Each insurance coverage plan has its own formulary (covered drug list), so you'll wish to examine to see which one will best cover the medications you need. If you wish to enroll in a catastrophic plan and you're 30 or older, you'll need hardship exemption (note that premium aids can not be used with disastrous strategies, so these are usually just an excellent idea if you don't certify for a premium subsidy, but can fulfill the requirements for a challenge exemption).

See This Report on How To Cancel State Farm Insurance

You're going to have to do some research study on your own (how much does an eye exam cost without insurance). The very first thing you can do is speak to your liked one's financial consultants, if they had any. This individual ought to be able to inform you if there is an active life insurance coverage policy. The next step you could take would be to go through your loved one's mail.

However, a growing number of life insurance coverage business are going digital, so this might not pan out. And when you're looking through your enjoyed one's financial resources, check the bank declarations to see if any payments were made to a life insurance business. If you have actually still do not discover any evidence of a life insurance policy, you can call your state's insurance coverage department and request assistance. what is the minimum insurance requirement in california?.

While you're there have a look at their free policy locator tool. If your loved one had a life insurance coverage policy and you're the beneficiary, the NAIC might be able to find the info and share it with you. If none of these actions work, the next action to take would be to employ a service to search for the life insurance policy on your behalf.

But keep in mind each business has different rates and restrictions. So pick wisely. Some alternatives are MIB.com and policyinspector. com. However understand that https://www.globalbankingandfinance.com/category/news/wesley-financial-group-reap-awards-for-workplace-excellence/ there are fraudsters out there who say they will assist for an upfront expense and after that are never heard from once again. So be sure to do your research study before employing a service.

The 8-Minute Rule for What Is The Minimum Insurance Requirement In California?

So one might never ever turn up. So if you have a life insurance policy, or a planning on buying one, do not conceal the reality from your household. Have a discussion about it. Death is not the simplest topic to discuss but it's a crucial one. It sure is. If you have any questions about life insurance, leave us a comment.

On November 13, 2014, the Florida Workplace of Insurance Policy, Florida Department of Financial Services and the Florida Office of the Attorney general of the United States revealed a$ 3. 2million life claim settlement contract with the Sun Life Business, that includes the Sun Life Guarantee Business of Canada, Delaware Life Insurance Company, Independence Life and Annuity Company, Expert Insurer, Sun Life & Medical Insurance Company, and Delaware Life Insurance Coverage Company of New York City.

Sun Life has actually consented to carry out organization reforms remedying this practice and to make a payment, which will be paid out amongst the getting involved states. Florida's allowance of the $3. 2 million payment is expected to be more than $227,000. The multi-state evaluation was carried out by Florida, which worked as the lead state, California, Connecticut, Illinois, Michigan, New Hampshire, North Dakota and Pennsylvania.

For more information, visit the Florida Office of Insurance coverage Policy's Life Claim Settlement Practices website. If you or someone you understand is a victim of this practice, please get in touch with the Florida Department of Financial Services, Insurance Helpline at 1-877-MY-FL-CFO (693-5236) for more information.

How To Get Rid Of Mortgage Insurance Can Be Fun For Anyone

Life insurance coverage documentation often gets lost or goes unnoticed after an enjoyed one passes away. Every year, millions of dollars in life insurance profits are unclaimedsimply since the recipients do not understand about the policies. Do not lose out on insurance cash to which you're entitled. Learn what happens to all that money and how you can look for an unclaimed life insurance coverage policy.

But in cases where the company can't locate recipients in a specific amount of time, every state requires the company to turn over the unclaimed life insurance coverage proceeds to the state. Recipients can claim the cash from the statemillions of dollars sit in state coffers, simply waiting. Here are ten methods to find unclaimed life insurance coverage advantages.

Some policies remain in force long after all the required premiums have been paid. If the deceased was still making payments on the policy, you'll most likely get a bill when the next premium is due. Even if payments weren't needed, the company might send regular statements setting out the value of the policy.

Some life insurance policies pay interest. So, you might find proof of those payments in old income tax return. Similarly, check old bank declarations to see if any checks or automated payments have actually been constructed out to life insurance business over the years. If you think your member of the family had a policy with a specific company, call and ask.

Unknown Facts About How Much Does Pet Insurance Cost

You may likewise discover aid on the company's site; MetLife, for circumstances, has an online search feature. If the departed individual had a safe-deposit box, check there for an insurance plan or related documents. Call the departed person's house owners' and vehicle insurance coverage representative to discover if that representative also sold life insurance coverage to the decedent.

Lots of states offer free unclaimed life insurance coverage search services. Also, the National Association of Insurance Coverage Commissioners (NAIC) helps consumers locate life insurance coverage policies and annuity agreements of deceased individuals. If it's been more than a year or more considering that the death, call the state's unclaimed home department. If you're uncertain where to start, go to the National Association of Unclaimed Home Administrators website.

The MIB Group, for instance, has a database of policies, which it will look for a charge. But many paid-for searches aren't effective, even if a policy is in place. After you buy a life insurance policy (or policies), you can keep your household from being among the millions who lose https://www.benzinga.com/pressreleases/20/02/g15395369/franklin-tenn-based-wesley-financial-group-recognized-as-2020-best-places-to-work-in-u-s out on the advantages they had coming.

If your beneficiaries are childrenor you don't wish to give this information to them for any other reasongive it to the individual you called as executor in your will. Also, make sure that the beneficiaries' info on the policy depends on date. Your household members may not have any concept about the insurance coverage you own.

An Unbiased View of How Much Does Mortgage Insurance Cost

Organize the files so that your recipients can quickly learn about advantages and ensure they understand where you keep your estate documents.

If you are searching for out if you, a relative or good friend has a life insurance coverage policy, however you do not have the policy file and do not understand the name of the insurer that released it: check your own, or the other person's, savings account/ credit card statements for proof of payments to an insurance provider contact the Unclaimed Assets Register online or by phone on 0333Â 000Â 0182.

Our handy Tracking your Pension page can likewise assist you discover missing life insurance coverage policies. To discover if you have any forgotten pension pots, you might do the following: Start with checking out old policy documents and bank declarations, there need to be some information about your company (how to shop for health insurance). The majority of companies need to have their contact details on their interactions and websites.

You could utilize the Cash Guidance Service's free template letter to request your policy's information from the company. If you have a workplace pension with a previous company, you might contact them for your plan or company's details. Alternatively, you could use the Federal government's totally free Pension Tracing Service.

The Only Guide for What Is Coinsurance In Health Insurance

If your automobile is totaled, gap insurance will help settle the balance of your loan. No-fault pays medical expenditures, and in some cases, loss of income, vital services, unexpected death, funeral expenses, and survivor benefits. If you've had tickets, accidents, a DUI, or require an SR-22, Freeway Insurance can help. who is eligible for usaa insurance.

The advice of our insurance experts will help you find the very best rates based on your particular situation. In addition to, there are other advantages to insuring your cars and truck through Freeway: Highway is recognized as a brand name you can rely on and has been helping drivers conserve cash on vehicle insurance for over thirty years We offer a vast array of automobile insurance coverage options from one of the most basic to premium Affordable auto insurance coverage for high-risk drivers who have actually been rejected in other places due to tickets, mishaps, DUI, or SR-22 requirements Over 500 practical office places where you can pay your bill or discuss your policy English and Spanish-speaking representatives available to address your questions in individual or by phone Freeway Insurance coverage makes it easy to get.

You can also stop by one of our conveniently-located workplaces where an insurance specialist will assist you discover the ideal policy. Have questions? Visit our car insurance coverage Frequently asked questions.

So why is it some vehicles seem more "insurable" than others? Is it a predisposition toward make or model? What about price range or trim level? While some of that is relevant, it is a much larger image response than that. Among numerous factors, insurer consider what it costs to fix or change your automobile when determining rate.

The Best Strategy To Use For How Much Is A Doctor Visit Without Insurance

In reality, some cars, merely by virtue of their style and manufacture, will conserve vehicle shoppers money on their car insurance coverage. https://diigo.com/0j8yye We took a look at the top 100 make and design mixes for 2018 automobiles to assemble a list of the cheapest cars to guarantee. 4 of the top 6 spots are held by crossovers and SUVs.

Rank Green Vehicles 1 Honda Fit 2 Ford Carnival SFE 3 Honda CR-V 4 MINI Cooper Countryman 5 Ford Edge 6 Mazda3 (5-door) 7 Toyota Highlander Hybrid LE Plus 8 Hyundai Elantra 9 Ford Focus Electric FWD 10 Toyota RAV4 LE/XLE Electric lorries have come a long method, as the market has actually seen a stable stream of brand-new models that you can purchase.

Rank Electric Automobiles 1 Fiat 500e 2 Kia Soul EV 3 Nissan Leaf 4 Volkswagen e-Golf 5 Smart ForTwo Electric Drive 6 Mitsubishi i-MiEV 7 Ford Focus Electric 8 Hyundai IONIQ Electric 9 BMW i3 10 Tesla Design 3 The National Highway Traffic Security Administration's (NHTSA) 5-Star Safety Rankings Program provides customers with information about the crash security and rollover security of brand-new automobiles, with more stars equating to much safer cars.

Rank Vehicles for Teenager Drivers 1 Kia Sportage 2 Kia Soul 3 Hyundai Tucson 4 Honda CR-V LX 5 Honda Fit 6 Hyundai Elantra GT 7 VW Golf Sportwagen SW 8 Subaru Wilderness 9 Dodge Dart 10 Honda HR-V EX.

8 Easy Facts About How Much Does Homeowners Insurance Cost Described

Discovering the cheapest auto insurance takes some know-how and research. Let's face it: it's a tedious job. You might be lured to skip the legwork and just restore your policy without any cost savings. However do not stress. By making a few, smart decisions, you can find the least expensive car insurance for your circumstance, and not jeopardize the protection you require to safeguard yourself financially.

Comparing cars and truck insurance coverage estimates from multiple insurer is the most effective way to get low-cost automobile insurance coverage. Our group of insurance specialists researched vehicle insurance prices estimate fielded from significant companies for various driver profiles and protection levels to find the most economical automobile insurance coverage rates. The information below program typical costs broken down by different variables to highlight elements that might increase or reduce your rates, and to give you an idea of what you can anticipate to pay.

Below, you'll see the leading five most affordable vehicle insurance provider listed with their average rates for coverage. Geico was the most budget-friendly among the insurance companies investigated, and the rest of the companies are all within a $100 of each other. why is car insurance so expensive. The exact same applies when looking at how cars and truck insurance business rank on rate for simply state needed minimum protection.

And yet, you do not desire to purchase cheap vehicle insurance and then be stressed that you aren't sufficiently covered. Low-cost automobile insurance must never be almost rate it implies discovering the coverage you require at an expense that fits your budget plan. Our editors and consumer analyst will show you how to find vehicle insurance that has the very best worth for you at a rate that will still net you cost savings.

Some Known Facts About How Much Does A Doctor Visit Cost Without Insurance.

Rates vary by hundreds of dollars amongst business, which is why it literally pays to search. For example, our specialists carried out a rate analysis and discovered the following potential savings, or the difference between the greatest and lowest cost, for the very same policy: Complete coverage typical cost savings of as much as 178% or $1,1647 When broken down by state, savings are much more considerable in many cases.

But even in states where the savings are much lower, you can still avoid overpaying by hundreds of dollars. Read more about typical car insurance savings by stateIf you're wondering who has the cheapest car insurance near you, our rate information can help. Here we reveal typical cars and truck insurance rates from significant insurance providers, ranked from least to most pricey, for every state, for a complete protection policy.

The Greatest Guide To How To Get Health Insurance After Open Enrollment

If your automobile is amounted to, space insurance will help pay off the balance of your loan. No-fault pays medical expenses, and in many cases, loss of income, vital services, accidental death, funeral service costs, and survivor benefits. If you've had tickets, accidents, a DUI, or need an SR-22, Freeway Insurance can help. how many americans don't have health insurance.

The recommendations of our insurance coverage professionals will help you discover the best rates based on your particular situation. In addition to, there are other benefits to insuring your cars and truck through Freeway: Highway is recognized as a brand name you can rely on and has actually been helping drivers conserve cash on vehicle insurance for over thirty years We provide a wide variety of vehicle insurance alternatives from the most fundamental to premium Budget friendly car insurance coverage for high-risk drivers who have been declined in other places due to tickets, accidents, DUI, or SR-22 requirements Over 500 convenient workplace places where you can pay your costs or discuss your policy English and Spanish-speaking agents available to address your questions face to face or by phone Highway Insurance coverage makes it simple to get.

You can also come by among our conveniently-located workplaces where an insurance coverage expert will assist you find the right policy. Have concerns? Visit our automobile insurance coverage Frequently asked questions.

So why is it some vehicles appear to be more "insurable" than others? Is it a predisposition toward make or model? What about price variety or trim level? While some of that is appropriate, it is a much bigger picture answer than that. Among numerous elements, insurance business consider what it costs to fix or replace your vehicle when determining rate.

9 Simple Techniques For How To Get A Breast Pump Through Insurance

In reality, some lorries, just by virtue of their style and manufacture, will save automobile consumers money on their auto insurance. We analyzed the leading 100 make and model combinations for 2018 lorries to compile a list of the most affordable vehicles to insure. Four of the leading six areas are held by crossovers and SUVs.

Rank Green Vehicles 1 Honda Fit 2 Ford Carnival SFE 3 Honda CR-V 4 MINI Cooper Compatriot 5 Ford Edge 6 Mazda3 (5-door) 7 Toyota Highlander Hybrid LE Plus 8 Hyundai Elantra 9 Ford Focus Electric FWD 10 Toyota RAV4 LE/XLE Electric vehicles have actually come a long method, as the market has actually seen a constant stream of new models that you can buy.

Rank Electric Automobiles 1 Fiat 500e 2 Kia Soul EV 3 Nissan Leaf 4 Volkswagen e-Golf 5 Smart ForTwo Electric Drive 6 Mitsubishi i-MiEV 7 Ford Focus Electric 8 Hyundai IONIQ Electric 9 BMW i3 10 Tesla Model 3 The National Highway Traffic Safety Administration's (NHTSA) 5-Star Security Rankings Program provides customers with info about the crash protection and rollover security of brand-new automobiles, with more stars equating to more secure vehicles.

Rank Cars for Teen Drivers 1 Kia Sportage 2 Kia Soul 3 Hyundai Tucson 4 Honda CR-V LX 5 Honda Fit 6 Hyundai Elantra GT 7 VW Golf Sportwagen SW 8 Subaru Outback 9 Dodge Dart 10 Honda HR-V EX.

The smart Trick of What Is Coinsurance In Health Insurance That Nobody is Talking About

Discovering the cheapest car insurance coverage takes some know-how and research study. Let's face it: it's a laborious task. You may be lured to skip the legwork and just restore your policy without any cost savings. However do not stress. By making a couple of, wise choices, you can find the cheapest automobile insurance coverage for your situation, and not jeopardize the coverage you require to secure yourself economically.

Comparing car insurance prices quote from multiple insurance provider is the most efficient way to get low-cost cars and truck insurance coverage. Our group of insurance experts researched cars and truck insurance coverage prices quote fielded from significant business for various chauffeur profiles and protection levels to discover the most budget friendly automobile insurance coverage rates. The data below program average costs broken down by various variables to highlight factors that might increase or decrease your rates, and to offer you a concept of what you can anticipate to pay.

Below, you'll see the top five least expensive automobile insurance provider noted with their typical rates for protection. Geico was the most economical among the insurers researched, and the rest of the business are all within a $100 of each other. how do i know if i have gap insurance. The same holds real when taking a look at how automobile insurance business rank on cost for just state required minimum protection.

And yet, you don't wish to purchase cheap vehicle insurance and then be stressed that you aren't adequately covered. Low-cost vehicle insurance should never be just about price it means finding the protection you need at an expense that fits your budget. Our editors and customer expert will show you how to find vehicle insurance that has the best value for you at a rate that will still net you cost savings.

About How Much Does Life Insurance Cost

Rates vary by numerous dollars amongst companies, which is why it actually pays to look around. For example, our specialists performed a rate analysis and found the following possible cost savings, or the difference between the highest and least expensive rate, for the same policy: Full protection average cost savings of as much as 178% or $1,1647 When broken down by state, cost savings are much https://diigo.com/0j8yye more significant sometimes.

But even in states where the savings are much lower, you can still avoid paying too much by hundreds of dollars. Find out more about typical vehicle insurance coverage cost savings by stateIf you're questioning who has the most inexpensive vehicle insurance near you, our rate information can assist. Here we reveal average car insurance coverage rates from major insurers, ranked from least to most pricey, for every single state, for a full coverage policy.

Everything about How Do I Know If I Have Gap Insurance

The insurance market is insurance coverage agents using items on behalf of insurance provider. Representatives earn money a commission by the insurance provider to offer their items. Some representatives work as brokers, others work in a group setting or are captive (devoted to one insurance coverage business). To sell insurance of any kind there are generally two requirements. A base income. Commission. A reward or reward. All 3 of these payment techniques define how insurance agents make money. However, which payment methods apply depend upon: Representative typeExperienceLocation Insurance representatives are paid differently depending on if they are captive or independent. Here's how to discriminate in between the 2: This type of agent works entirely for one particular insurance provider.

They get leads from the company and represent the products it sells. This type of representative offers products from various insurance companies. They do not have a loyalty to any one insurer and usually operate in their own workplace or as part of an independent agency. But they do participate in a contract that provides binding authority to offer insurance policies on the behalf of various insurance coverage business.

Independent representatives can grow their book of organization much faster than captive representatives because they are more taken part in their neighborhood and use more individualized service. They can typically make greater commissions but receive little to no base income. With both kinds of insurance representatives, the specific representative functions as an intermediary between https://omarlbck772.wixsite.com/lukasxlid085/post/the-smart-trick-of-how-much-does-flood-insurance-cost-that-nobody-is-talking-about the customer and the insurance company.

The payment structure of an insurance coverage agent is influenced by where they work. Those who work as a sales agent for one insurance provider, representing just that insurance company's items, typically earn money in among three ways: Salary onlySalary plus commissionSalary, commission and bonus offer Representatives who work for an independent insurance firm selling products from selected business generally earn a little income and commissions, OR a salary plus a bonus offer if the company fulfills its objectives.

The 2017 mean yearly wage for an insurance agent is $49,710 and the per hour wage is $23. 90 per hour, according to the U.S. Department of Labor's Bureau of Labor Stats, New agents make less than $27,180, while those with years in business can make upwards of $125,190. Together with a base pay, captive representatives also receive an employer-sponsored benefits plan, in addition to supporting personnel, office devices, marketing and advertising efforts.

A representative's base commission depends several factors like: The line of insuranceThe number of new policies soldThe variety of renewing policiesThe commission structure, if any, of the insurance coverage company or agency Captive representatives typically earn a 5% to 10% commission for each car and home insurance plan they offer. Each time the policy restores, they get a recurring commission, which is generally less than the preliminary commission.

Independent agents make more in commission than captive representatives due to the fact that they either receive no base salary or an extremely small one. According to the Independent Insurance Coverage Agents & Brokers of America, Inc. (IIABA), independent representatives usually make the following range of commissions on these policy types: Between 8% and 15% of a brand-new policy's first year premium and in between 2% and 15% at the policy's renewal.

The smart Trick of How To Become An Insurance Agent In Texas That Nobody is Talking About

Given that life and health insurance commissions are front-loaded, representatives typically do not receive a commission after the 3rd policy renewal. Sometimes, captive and independent agents might earn contingent commissions, which are incentive-based. Insurance coverage companies or companies might set certain goals for accomplishing contingent commissions, such as: Reaching a particular volume of businessPolicy retentionGrowing a specific line of insuranceOverall success Overall, no matter the type of representative, the greater an agent's book of business, the more commissions he or she earns.

Many U.S. states have disclosure laws that need representatives and brokers to supply this info. Some insurance coverage agents may get quarterly, semiannual, or year-end bonuses based upon their sales performance. For captive representatives, performance rewards can amount to 20% or more of their earnings. Independent representatives typically do not receive efficiency benefits unless they work for an independent insurance agency that provides such chances.

Experience matters when it pertains to how much insurance coverage representatives can make. For both captive and independent insurance coverage representatives, the more years working as a representative, the more clients they acquire and the more strong their credibility ends up being as a trusted agent. This relationship structure translates into new organization and continued renewals, increasing an agent's commission from year to year.

Insurance coverage rates are figured out by an area's cost of living, how numerous accidents occur, the total health of its locals, the criminal activity rate and other stats. For representatives, area can affect insurance sales because: The cost of insurance coverage is so high that many residents would go without it. Individuals are leaving the location due to a high expense of living.

There are more representatives in the market than prospective customers. There is higher competitors in the place. Locals tend to go shopping more online than locally. The expense of insurance coverage is high, so representatives can make more commission. The cost of insurance is low, so agents don't make as much commission.

So, what representative services are consumers getting for their cash? An agent understands all the ins and outs of the insurance coverage products she or he is offering (how to be a successful insurance agent). They use this understanding to help consumers select the best policy to meet their needs and spending plan - what is an independent insurance agent. Insurance agents are needed to be accredited in each state in which they do business.

Some insurance coverage agents have actually expanded their understanding of insurance coverage by finishing courses and passing test requirements for insurance designations. Amongst the top designations are: Certified Insurance Coverage Counselor (CIC) Chartered Life Underwriter (CLU) Chartered Home Casualty Underwriter (CPCU) Commercial Lines Protection Expert (CLCS) Accredited Consultant in Insurance Coverage (AAI) Partner in General Insurance Coverage (AINS) Accredited Customer Service Representative (ACSR) Personal Lines Coverage Expert (PLCS) Partner in Insurance Solutions (AIS) Health Care Compliance Specialist (HCP) Group Advantages Associate (GBA) Fellow, Health Insurance Advanced Research Studies (FHIAS) Certified Monetary Planner (CFP) Financial Services Certified Expert (FSCP) You'll see one or more of these designations after the insurance coverage agent's name.

How To Become A Progressive Insurance Agent Fundamentals Explained

For consumers searching for an insurance agent, understanding the payment structure of your representative provides openness and assists construct trust. Weigh this details with the agent's professionalism and competence to build a relying on relationship.

The Ultimate Guide To How Many Americans Have Health Insurance

If your automobile is totaled, gap insurance will assist pay off the balance of your loan. No-fault pays medical costs, and in many cases, loss of income, vital services, accidental death, funeral expenditures, and survivor advantages. If you've had tickets, accidents, a DUI, or need an SR-22, Freeway Insurance can assist. how long can children stay on parents insurance.

The guidance of our insurance coverage experts will assist you discover the finest rates based upon your particular scenario. In addition to, there are other advantages to insuring your vehicle through Freeway: Freeway is acknowledged as a brand name you can trust and has been assisting chauffeurs save cash on auto insurance for over thirty years We provide a wide variety of car insurance alternatives from the a lot of standard to premium Budget-friendly vehicle insurance policies for high-risk chauffeurs who have been declined somewhere else due to tickets, accidents, DUI, or SR-22 requirements Over 500 practical office areas where you can pay your bill or discuss your policy English and Spanish-speaking representatives readily available to address your questions in person or by phone Freeway Insurance makes it easy to acquire.

You can likewise drop in one of our conveniently-located workplaces where an insurance professional will help you discover the best policy. Have questions? Visit our auto insurance coverage Frequently asked questions.

So why is it some cars seem more "insurable" than others? Is it a bias toward make or design? What about price variety or trim level? While a few of that is pertinent, it is a much larger photo answer than that. Among numerous elements, insurance coverage companies take into account what it costs to fix or change your car when determining rate.

9 Simple Techniques For What Is Sr-22 Insurance

In fact, some cars, just by virtue of their design and manufacture, will conserve car buyers money on their auto insurance. We examined the top 100 make and model mixes for 2018 vehicles to assemble a list of the most affordable automobiles to insure. Four of the leading 6 spots are held by crossovers and SUVs.

Rank Green Vehicles 1 Honda Fit 2 Ford Fiesta SFE 3 Honda CR-V 4 MINI Cooper Compatriot 5 Ford Edge 6 Mazda3 (5-door) 7 Toyota Highlander Hybrid LE Plus 8 Hyundai Elantra 9 Ford Focus Electric FWD 10 Toyota RAV4 LE/XLE Electric vehicles have actually come a long way, as the marketplace has seen a stable stream of brand-new models that you can buy.

Rank Electric Cars 1 Fiat 500e 2 Kia Soul EV 3 Nissan Leaf 4 Volkswagen e-Golf 5 Smart ForTwo Electric Drive 6 Mitsubishi i-MiEV 7 Ford Focus Electric 8 Hyundai IONIQ Electric 9 BMW i3 10 Tesla Model 3 The National Highway Traffic Safety Administration's (NHTSA) 5-Star Safety Scores Program provides customers with information about the crash protection and rollover security of new cars, with more stars equating to safer automobiles.

Rank Vehicles for Teenager Drivers 1 Kia Sportage 2 Kia Soul 3 Hyundai Tucson 4 Honda CR-V LX 5 Honda Fit 6 Hyundai Elantra GT 7 VW Golf Sportwagen SW 8 Subaru Outback 9 Dodge Dart 10 Honda HR-V EX.

3 Easy Facts About How Much Does Flood Insurance Cost Explained

Finding the cheapest automobile insurance coverage takes some knowledge and research study. Let's face it: it's a tedious job. You may be tempted to avoid the legwork and just restore your policy with no cost savings. However do not worry. By making a couple of, wise decisions, you can discover the most affordable vehicle insurance coverage for your circumstance, and not jeopardize the coverage you require to secure yourself economically.

Comparing cars and truck insurance coverage estimates from multiple insurance coverage companies is the most efficient method to get inexpensive vehicle insurance. Our team of insurance experts looked into car insurance estimates fielded from major business for different driver profiles and protection levels to discover the most budget friendly cars and truck insurance rates. The data below program typical expenses broken down by various variables to highlight aspects that might increase or decrease your rates, and to provide you an idea of what you can expect to pay.

Listed below, you'll see the leading five most affordable automobile insurance provider listed with their typical rates for protection. Geico was the most budget friendly amongst the insurance providers looked into, and the rest of the business are all within a $100 of each other. how to apply for health insurance. The exact same applies when taking a look at how automobile insurance provider rank on rate for simply state needed minimum protection.

And yet, you do not want to purchase cheap cars and truck insurance coverage and then be stressed that you aren't sufficiently covered. Inexpensive cars and truck insurance need to never be almost price it means discovering the protection you need at an expense that fits your budget. Our editors and consumer expert will reveal you how to find automobile insurance coverage that has the best value for you at a rate that will still net you cost savings.

Getting My What Is A Health Insurance Deductible To Work

Rates vary by hundreds of dollars amongst business, which is why it actually pays to shop around. For instance, our professionals conducted a rate analysis and found the following prospective cost savings, or the distinction between the highest and least expensive price, for the same policy: Complete coverage average savings of approximately 178% or $1,1647 When broken down by state, cost savings are even more significant in some cases.

However even in states where the savings are much lower, you can still avoid paying https://diigo.com/0j8yye too much by hundreds of dollars. Check out more about typical cars and truck insurance coverage cost savings by stateIf you're questioning who has the most affordable car insurance coverage near you, our rate data can assist. Here we reveal typical vehicle insurance coverage rates from major insurance providers, ranked from least to most costly, for each state, for a full coverage policy.

How How Much Does Mortgage Insurance Cost can Save You Time, Stress, and Money.

The insurance industry is insurance agents providing products on behalf of insurance provider. Representatives earn money a commission by the insurance business to sell their items. Some agents work as brokers, others operate in a group setting or are captive (faithful to one insurance provider). To offer insurance of any kind there are usually 2 requirements. A base pay. Commission. A reward or bonus offer. All 3 of these payment techniques define how insurance agents make money. Nevertheless, which payment methods apply depend on: Representative typeExperienceLocation Insurance agents are paid in a different way depending on if they are captive or independent. Here's how to tell the difference in between the two: This kind of agent works entirely for one specific insurance coverage business.

They get leads from the company and represent the items it sells. This kind of agent provides items from numerous insurance coverage business. They do not have an obligation to any one insurance coverage business and normally work in their own office or as part of an independent company. However they do enter into an agreement that offers them binding authority to sell insurance plan on the behalf of different insurance provider.

Independent representatives can grow their book of organization much faster than captive representatives due to the fact that they are more participated in their community and use more personalized service. They can frequently earn greater commissions but get little to no base wage. With both kinds of insurance coverage agents, the private agent acts as an intermediary in between the customer and the insurance business.

The payment structure of an insurance coverage representative is affected by where they work. Those who work as a sales agent for one insurer, representing only that insurer's products, normally make money in one of 3 ways: Salary onlySalary plus commissionSalary, commission and benefit Agents who work for an independent insurance firm offering products from selected companies normally earn a small salary and commissions, OR a wage plus a bonus if the firm fulfills its objectives.

The 2017 median yearly wage for an insurance coverage agent is $49,710 and the per hour wage is $23. 90 per hour, according to the U.S. Department of Labor's Bureau of Labor Statistics, New representatives earn less than $27,180, while those with years in business can make upwards of $125,190. Along with a base pay, captive representatives also get an employer-sponsored advantages plan, along with supporting staff, office devices, marketing and advertising efforts.

An agent's base commission depends numerous elements like: The line of insuranceThe number of new policies soldThe variety of renewing policiesThe commission structure, if any, of the insurance provider or company Captive representatives typically earn a 5% to 10% commission for each auto and home insurance coverage policy they sell. Each time the policy restores, they get a recurring commission, which is usually less than the preliminary commission.

Independent representatives https://omarlbck772.wixsite.com/lukasxlid085/post/the-smart-trick-of-how-much-does-flood-insurance-cost-that-nobody-is-talking-about make more in commission than captive agents because they either receive no base wage or a very little one. According to the Independent Insurance Coverage Agents & Brokers of America, Inc. (IIABA), independent agents normally earn the following variety of commissions on these policy types: Between 8% and 15% of a brand-new policy's very first year premium and in between 2% and 15% at the policy's renewal.

The Definitive Guide to How Much Does An Insurance Agent Make A Year

Considering that life and medical insurance commissions are front-loaded, representatives usually don't get a commission after the third policy renewal. At times, slave and independent agents may earn contingent commissions, which are incentive-based. Insurance provider or agencies might set specific goals for achieving contingent commissions, such as: Reaching a specific volume of businessPolicy retentionGrowing a particular line of insuranceOverall profitability In general, no matter the type of agent, the higher a representative's book of organization, the more commissions he or she earns.

A lot of U.S. states have disclosure laws that require agents and brokers to provide this information. Some insurance coverage agents might receive quarterly, semiannual, or year-end benefits based on their sales performance. For captive representatives, performance benefits can amount to 20% or more of their earnings. Independent representatives normally do not get performance benefits unless they work for an independent insurance agency that uses such chances.

Experience matters when it pertains to just how much insurance coverage agents can make. For both captive and independent insurance agents, the more years working as a representative, the more customers they get and the more solid their reputation becomes as a relied on representative. This relationship structure equates into new business and continued renewals, increasing a representative's commission from year to year.

Insurance rates are figured out by an area's expense of living, how many accidents happen, the total health of its locals, the criminal activity rate and other data. For representatives, place can affect insurance sales due to the fact that: The expense of insurance coverage is so high that lots of citizens would go without it. Individuals are leaving the location due to a high expense of living.

There are more agents in the market than prospective clients. There is greater competition in the area. Citizens tend to shop more online than locally. The expense of insurance is high, so representatives can earn more commission. The cost of insurance is low, so agents don't make as much commission.

So, what agent services are customers getting for their money? An agent knows all the ins and outs of the insurance coverage items he or she is selling (how to become an insurance agent). They use this knowledge to assist clients pick the very best policy to fulfill their requirements and spending plan - how to become insurance agent. Insurance coverage agents are needed to be certified in each state in which they operate.

Some insurance representatives have expanded their understanding of insurance coverage by finishing courses and passing test requirements for insurance classifications. Amongst the leading designations are: Certified Insurance Coverage Therapist (CIC) Chartered Life Underwriter (CLU) Chartered Residential Or Commercial Property Casualty Underwriter (CPCU) Commercial Lines Protection Expert (CLCS) Accredited Consultant in Insurance (AAI) Partner in General Insurance (AINS) Accredited Customer Support Agent (ACSR) Personal Lines Protection Professional (PLCS) Associate in Insurance Coverage Solutions (AIS) Healthcare Compliance Professional (HCP) Group Advantages Partner (GBA) Fellow, Medical Insurance Advanced Studies (FHIAS) Qualified Financial Coordinator (CFP) Financial Providers Certified Expert (FSCP) You'll see one or more of these classifications after the insurance representative's name.

The Ultimate Guide To What Do The Letters Clu Stand For In Relation To An Insurance Agent

For consumers searching for an insurance coverage representative, understanding the payment structure of your representative supplies openness and assists develop trust. Weigh this information with the representative's professionalism and expertise to build a relying on relationship.

7 Easy Facts About What Does Term Life Insurance Mean Shown

If your automobile is amounted to, gap insurance coverage will assist pay off the balance of your loan. No-fault pays medical expenditures, and in some cases, loss of earnings, important services, unexpected death, funeral service costs, and survivor benefits. If you have actually had tickets, https://diigo.com/0j8yye accidents, a DUI, or require an SR-22, Freeway Insurance coverage can assist. how does whole life insurance work.

The suggestions of our insurance professionals will help you find the very best rates based on your particular situation. In addition to, there are other advantages to guaranteeing your vehicle through Freeway: Freeway is acknowledged as a brand name you can rely on and has actually been helping chauffeurs conserve money on automobile insurance for over 30 years We use a vast array of auto insurance choices from the most standard to premium Economical vehicle insurance coverage for high-risk chauffeurs who have actually been rejected somewhere else due to tickets, mishaps, DUI, or SR-22 requirements Over 500 hassle-free office areas where you can pay your bill or discuss your policy English and Spanish-speaking representatives offered to answer your concerns in individual or by phone Freeway Insurance makes it simple to get.

You can likewise come by among our conveniently-located workplaces where an insurance professional will assist you discover the right policy. Have concerns? Visit our car insurance coverage FAQs.

So why is it some automobiles appear to be more "insurable" than others? Is it a predisposition toward make or model? What about cost variety or trim level? While some of that matters, it is a much bigger picture response than that. Among lots of aspects, insurance provider take into consideration what it costs to fix or change your lorry when determining rate.

How Much Is A Unit Of Colonial Penn Life Insurance? Fundamentals Explained

In reality, some lorries, simply by virtue of their style and manufacture, will conserve car consumers money on their automobile insurance coverage. We analyzed the top 100 make and model mixes for 2018 automobiles to put together a list of the least expensive lorries to insure. 4 of the leading 6 spots are held by crossovers and SUVs.

Rank Green Cars 1 Honda Fit 2 Ford Carnival SFE 3 Honda CR-V 4 MINI Cooper Fellow Citizen 5 Ford Edge 6 Mazda3 (5-door) 7 Toyota Highlander Hybrid LE Plus 8 Hyundai Elantra 9 Ford Focus Electric FWD 10 Toyota RAV4 LE/XLE Electric vehicles have actually come a long way, as the market has actually seen a consistent stream of new designs that you can purchase.

Rank Electric Automobiles 1 Fiat 500e 2 Kia Soul EV 3 Nissan Leaf 4 Volkswagen e-Golf 5 Smart ForTwo Electric Drive 6 Mitsubishi i-MiEV 7 Ford Focus Electric 8 Hyundai IONIQ Electric 9 BMW i3 10 Tesla Model 3 The National Highway Traffic Security Administration's (NHTSA) 5-Star Safety Scores Program offers consumers with information about the crash security and rollover security of new lorries, with more stars equaling safer vehicles.

Rank Vehicles for Teenager Drivers 1 Kia Sportage 2 Kia Soul 3 Hyundai Tucson 4 Honda CR-V LX 5 Honda Fit 6 Hyundai Elantra GT 7 VW Golf Sportwagen SW 8 Subaru Outback 9 Dodge Dart 10 Honda HR-V EX.

Not known Factual Statements About How To Shop For Health Insurance

Discovering the cheapest vehicle insurance coverage takes some knowledge and research study. Let's face it: it's a tedious task. You may be lured to avoid the legwork and simply renew your policy with no cost savings. However do not worry. By making a couple of, smart choices, you can find the least expensive car insurance coverage for your circumstance, and not compromise the protection you need to secure yourself financially.

Comparing car insurance quotes from multiple insurance provider is the most effective method to get inexpensive automobile insurance coverage. Our team of insurance experts investigated vehicle insurance coverage prices estimate fielded from significant companies for various chauffeur profiles and protection levels to discover the most budget-friendly automobile insurance rates. The data listed below show typical costs broken down by different variables to highlight elements that may increase or reduce your rates, and to offer you a concept of what you can expect to pay.

Below, you'll see the top 5 most affordable vehicle insurer listed with their average rates for protection. Geico was the most economical among the insurers researched, and the rest of the companies are all within a $100 of each other. who has the cheapest car insurance. The exact same is true when taking a look at how vehicle insurance provider rank on cost for simply state required minimum protection.

And yet, you don't wish to purchase cheap vehicle insurance and after that be stressed that you aren't sufficiently covered. Cheap vehicle insurance coverage need to never ever be almost cost it suggests finding the coverage you need at an expense that fits your budget. Our editors and consumer expert will show you how to discover cars and truck insurance coverage that has the very best value for you at a price that will still net you cost savings.

The Only Guide to How Much Does A Dental Bridge Cost With Insurance

Rates vary by hundreds of dollars amongst companies, which is why it literally pays to look around. For instance, our professionals performed a rate analysis and discovered the following possible savings, or the distinction in between the highest and most affordable cost, for the exact same policy: Full protection average cost savings of approximately 178% or $1,1647 When broken down by state, cost savings are a lot more significant sometimes.

But even in states where the savings are much lower, you can still avoid overpaying by numerous dollars. Learn more about average cars and truck insurance coverage savings by stateIf you're wondering who has the most inexpensive car insurance coverage near you, our rate data can help. Here we show typical vehicle insurance coverage rates from significant insurers, ranked from least to most expensive, for each state, for a full coverage policy.

Rumored Buzz on How To Get Cheap Health Insurance